What Is Value-Based Care (VBC) and Why Does It Matter to Digital Health Startups?

If you’ve been working in healthcare for any amount of time, you’ve heard of value-based care (VBC). That’s because this concept is fundamentally shifting our industry, finally steering us away from the traditional fee-for-service (FFS) model— where we pay providers for the volume of tests and procedures provided— towards a focus on patient outcomes and efficiency.

VBC represents a promising shift in how healthcare in the United States is delivered and financed. With its emphasis on quality over quantity, and offering financial incentives to boot, it is increasingly important for founders and innovators to understand its implications and opportunities.

In this article, I cover:

Let’s dive in.

TL;DR

Value-based care (VBC) is a healthcare model where providers are paid based on patient health outcomes rather than the volume of services rendered.

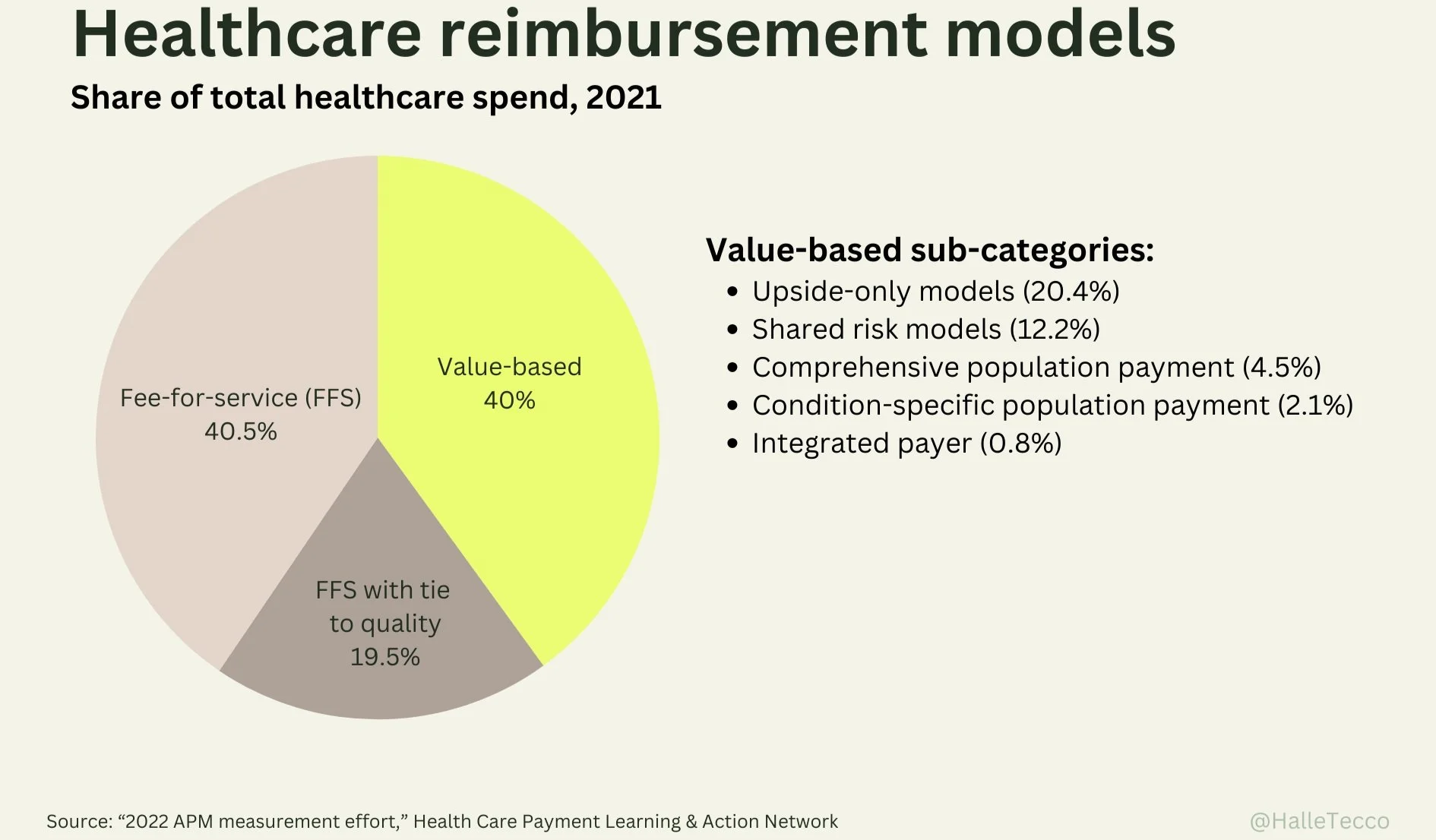

In 2021, nearly 60% of healthcare payments were tied to quality or value.

Venture dollars in value-based care startups quadrupled during the pandemic.

Studies of VBC programs so far suggest that they can reduce costs and improve quality of care, although results have often been mixed.

There’s an enormous opportunity for startups in VBC, including building enablement tools or becoming tech-enabled VBC providers themselves.

What is value-based care?

The term VBC was introduced by business school professors Michael Porter and Elizabeth Teisberg in their 2006 book Redefining Health Care.

VBC is a term for any healthcare delivery and payment model where the payment aligns provider incentives to quality or care cost-reduction. Under VBC agreements, providers are rewarded for helping patients improve their health, reduce the incidence and severity of chronic disease, and live healthier lives. This model contrasts with the traditional FFS approach, where providers are paid based on the number of healthcare services they deliver, such as tests and procedures, regardless of patient outcomes.

Does value-based care really work?

Studies of VBC programs so far suggest that they can reduce costs and improve quality of care, although results have often been mixed.

Humana, which offers value-based programs for Medicare Advantage patients, released a report finding that:

VBC patients spend more time with their physicians than their non-value-based counterparts.

VBC patients have better care outcomes than their non-value-based counterparts.

Physicians working under VBC models are also more empowered and better positioned to coordinate patient care and prioritize outcomes over service quantity.

VBC patients have 30.1% fewer hospital admissions compared to original Medicare beneficiaries.

VBC patients have 23.2% cost savings compared to original Medicare, averaging $527 in savings annually per patient.

On the other hand, a Congressional Budget Office testimony suggested that alternative payment models have not had a significant impact on the federal healthcare spending slowdown, but that the creation of the Center for Medicare & Medicaid Innovation (CMMI), which develops and tests new healthcare payment and service delivery models, may have led to broader system wide changes that have helped slow down healthcare spending.

Still, the healthcare industry has largely been bullish on VBC, because the status quo hasn’t worked. We pay more for healthcare than every other developed nation yet we have a lower life expectancy, spend more of our lives sick, and have the highest rate of avoidable deaths.

The healthcare industry has largely been bullish on VBC, because the status quo hasn’t worked. We pay more for healthcare than every other developed nation yet we have a lower life expectancy, spend more of our lives sick, and have the highest rate of avoidable deaths.

The legacy FFS model in healthcare ties reimbursements directly to the quantity of services provided. This approach often leads to an increased focus on performing numerous high-tech procedures and maximizing hospital occupancy, contributing to escalating healthcare costs without necessarily enhancing patient outcomes.

VBC hopes to shift the focus (and incentives) to the quality and efficacy of the care delivered, tying reimbursement to patient outcomes. This model motivates healthcare organizations to prioritize high-quality care, as it rewards positive outcomes and, conversely, can impose penalties for poor outcomes, heightened costs, and medical errors.

Simply put, VBC aligns financial incentives with the goal of delivering better patient care.

From volume to value: VBC is growing

The Health Care Payment Learning & Action Network (HCPLAN) estimates that VBC adoption nearly doubled from 2015 to 2021. And as of 2021, nearly 60% of healthcare payments were tied to quality or value.

Aetna, for instance, went from 0 value-based contracts in 2005 to over 75% of medical spend with value-based providers by 2020.

And, according to a McKinsey report, growth in VBC may accelerate from creating approximately $500 billion in enterprise value today to $1 trillion as the landscape matures.

Investors have taken note— venture dollars in value-based care startups quadrupled during the pandemic. Let’s dive into some of the exciting startups in this space.

Value-based care startups

Part of the reason why value-based care is possible now is because of advances in data analytics and software. Digital health tools can help with everything from patient engagement to population health management. There’s an enormous opportunity for founders to help build the future of VBC. Here are some of the roles startups can play in this space:

VBC enablement

VBC enablement products— including tools for physician enablement, population health management, cash flow modeling, quality reporting, measurement-based care (MBC), and more— can streamline patient care coordination and optimize resource allocation. Startups in the space include:

Aledade (raised $429M) helps primary care practices shift to VBC, find the right ACO, and manage their practice.

Vytalize ($172M) is a provider enablement platform focused on VBC.

Wellvana ($140M) drives innovation in value-based care enablement for independent primary care physicians, specialists, and health systems.

Pearl Health ($100M) helps primary care providers succeed in value-based care.

CardioOne ($8M) helps independent cardiology practices transition to value-based care models.

On Belay Health ($6.5M) provides tools for primary care teams to succeed in value-based care.

Greenspace ($1.4M) provides measurement-based care tools for mental health service providers.

VBC bridge builders

Because VBC contracts between multiple parties can be complex to execute, enablement solutions can support value-based collaboration, help manage onboarding, monitor outcomes, manage downstream distribution of funds, enable permissioned data sharing, and execute contracts and other time-consuming administrative tasks. Startups include:

Syntax ($8M) is a SaaS-based solution to help healthcare actuaries, network managers, analysts, and providers share data on savings, revenue, quality metrics, and trends.

HSBlox (funding unknown) provides end-to-end administration, simplifies communication between stakeholders, and operationalizes complex contracts for VBC models.

Episource (funding unknown) works with healthcare organizations and health plan providers to manage their risk adjustment and quality programs through data analytics and machine learning.

Tech-enabled VBC providers

Startups can also be tech-enabled VBC providers themselves. By leveraging software and patient-centric care models, startups can directly engage in delivering value-based care, focusing on preventative measures and personalized treatment plans. Their agility and tech-driven approach can enable them to quickly adapt to changing healthcare landscapes and effectively managing patient health outcomes while controlling costs. Notable companies in the space include:

Devoted Health ($2.1B) is a “payvider” combining Medicare Advantage plans with in-person and virtual care.

Cityblock ($900M) provides primary care, behavioral care, and social services in a VBC model (I’m an investor).

Crossover Health ($293M) is a national medical group that delivers primary care, physical medicine, mental health, health coaching, and care navigation.

Interwell Health (product of a three-way merger) is a value-based care company focused on services for the earlier stages of kidney disease (I’m an investor).

Homeward ($70M) delivers value-based care in rural America.

What’s next for value-based care and digital health

The concept of value-based care aligns perfectly with the objectives of digital health— to utilize technology to improve patient outcomes and reduce healthcare costs.

As more healthcare providers and payers shift to VBC models, there is a growing market for tools that help track, analyze, and improve patient outcomes. Digital health startups can develop tools for data analytics, patient monitoring, personalized health interventions, and more, all of which are critical in a VBC setting.

And because VBC models encourage (and frankly require) collaboration across the healthcare spectrum, startups have the opportunity to collaborate with healthcare stakeholders to develop solutions that fit within VBC frameworks.

VBC is reshaping the healthcare industry, making it more outcome-oriented. For digital health startups, this shift represents a chance to align new solutions with the emerging needs of a transforming healthcare landscape, providing ample opportunities for growth and collaboration.

Can Value-Based Care Save Our Healthcare System?

The number of Americans with a primary care physician is declining along with the number of medical school graduates wanting to go into primary care. A big reason for this is how, and how much, they are paid. Can replacing our fee-for-service model with value-based care save our healthcare system? In this episode, Dr. Farzad Mostashari, former National Coordinator for Health IT at HHS and current Co-Founder and CEO of Aledade, dives into the what, why, and how of value-based care solutions.

Listen: Spotify // Apple Podcasts

Value-based care glossary

VBC is the overarching concept of designing care models to focus on quality, provider performance, and the patient experience. There are a lot of fancy terms and acronyms thrown around in this space, so let’s go over them. Note that a lot of these definitions sound similar, and that’s because they are.

Accountable Care Organizations (ACOs)

ACOs are networks of providers and hospitals that share responsibility for providing coordinated care to patients. They aim to reduce healthcare costs while improving quality, with providers jointly accountable for the health outcomes of their patients. ACOs are often associated with Medicare due to the significant role of the Medicare Shared Savings Program (MSSP) in promoting the ACO model.

Alternative Payment Models (APMs)

Alternative Payment Models refer to any payment approach that incentivizes quality and cost-efficient care, rather than the traditional fee-for-service model. APMs focus on providing financial incentives to healthcare providers for managing the health of their patients and aligning payment systems with improved health outcomes.

Bundled Payments

Any model involving a single, consolidated payment for all services provided during an episode of care. Bundled payments encourage healthcare providers to offer efficient, coordinated treatment. This is also sometimes called an Episode Payment Model by The Centers for Medicare and Medicaid Services (CMS).

Care Coordination

Care Coordination refers to the deliberate organization of patient care activities and sharing of information across multiple healthcare providers. Care coordination can ensure that healthcare services are delivered in a comprehensive and seamless manner.

Capitation

Capitation, or pre-payment, is when healthcare providers receive an upfront, fixed, per-patient payment to cover a specified period of care. This model incentivizes providers to offer comprehensive and preventive care to avoid unnecessary services.

Center for Medicare and Medicaid Innovation (CMMI)

CMMI, established by the Affordable Care Act, is tasked with developing and testing innovative healthcare payment and service delivery models. Its mission is to reduce costs in Medicare, Medicaid, and the Children's Health Insurance Program (CHIP), while enhancing the quality of care for beneficiaries. CMMI plays a pivotal role in fostering healthcare transformation by encouraging the adoption of models that promote patient-centered, cost-effective care.

Medicare Shared Savings Program (MSSP)

MSSP is a key component of the U.S. government's efforts to transition towards value-based care. Under this initiative, providers come together to form ACOs with the goal of delivering high-quality service and care. If they achieve improved patient care and reduce healthcare costs below established benchmarks, these ACOs are eligible to share in the savings they generate for the Medicare program.

Population-Based Payments (PBP)

Population-based payments are a value-based payment providing healthcare providers with a pre-set budget to manage the health needs of a defined population. It encourages a focus on preventive care and efficient management of chronic conditions.

Risk arrangements

Risk arrangements are when a provider is held financially responsible for the quality and cost of care delivered to beneficiaries. This can include downside risk or shared savings. Risk arrangements incentivizes providers to improve quality and lower costs through strategies like care coordination and more preventive care.

Shared Savings

In shared savings models (a form of a risk arrangement), providers are rewarded for reducing healthcare spending for a defined patient group below a benchmark level while meeting quality standards, sharing in the savings generated.

Patient-Centered Medical Homes (PCMHs)

Patient-Centered Medical Homes are a model of primary care that is patient-centric, comprehensive, team-based, coordinated, and culturally-appropriate. PCMHs foster partnerships between individual patients, their personal providers, and when appropriate, the patient’s family, ensuring that care is provided in a respectful and responsive manner to the individual patient’s needs and preferences.

Pay-for-Performance

Pay-for-performance models, also known as value-based payments, compensate providers based on meeting specific performance benchmarks, such as patient outcomes and service quality, incentivizing high-quality, efficient care delivery.

Pay-for-Quality

The Pay-for-quality (P4Q) model rewards healthcare providers for meeting certain quality metrics, focusing on the effectiveness and patient-centered nature of care, rather than the quantity of services rendered.

Payvider

Payviders are healthcare organizations (e.g. Kaiser Permanente) that are both a payer and a healthcare provider, offering both insurance coverage and care to patients.