Seven Charts That Sum Up U.S. Healthcare In 2023

The great Medicaid unwinding led to at least 13 million people losing coverage

Last year represented a massive shift in health insurance for many Americans. At least 13 million people (37% of them children) were disenrolled from Medicaid in 2023, according to KFF.

Why? In April, Congress stopped the policy that let people remain on Medicaid without interruption, a rule that started during the pandemic. States were given 14 months to reevaluate eligibility for Medicaid or the Children’s Health Insurance Program (CHIP).

2. For the first time, more than half of Medicare beneficiaries enrolled in Medicare Advantage, solidifying the quiet shift in the privatization of Medicare

In 2023, more than half (51%) of eligible Medicare beneficiaries (30.8M people) enrolled in Medicare Advantage plans.

Also known as Medicare Part C, Medicare Advantage is an alternative to Original Medicare (Part A and Part B) offered by private insurance companies approved by Medicare (UnitedHealthcare and Humana account for nearly half of all Medicare Advantage plans). These plans combine the coverage of hospital insurance (Part A) and medical insurance (Part B), and often include additional benefits not covered by Original Medicare, such as routine vision, dental, hearing, and wellness programs.

This shift towards privatized management of Medicare benefits has some folks alarmed. Wendell Potter, who was on The Heart of Healthcare podcast last year pointed out that Medicare Advantage is neither Medicare, nor an advantage.

But the jury is still out. A review of published research on the topic found few differences between Medicare Advantage and traditional Medicare that are supported by strong evidence or have been replicated across multiple studies.

3. Employees paid more for employer-sponsored health insurance premiums

The average annual premium for employer-sponsored family health insurance rose by 7% year-over-year, higher than inflation, hitting $23,968, according to KFF. This marked a jump from 2022 when there was almost no increase in premiums.

On average, employees contributed a record $6,575 annually to their family health insurance premiums, about $500 more than in 2022. It’s looking like this will worsen in 2024— nearly one in four employers (23%) plan to raise employee contributions in the coming two years.

4. GLP-1 medications like Ozempic became a household name

On the 10-year anniversary of obesity being designated as a chronic disease by the AMA, and after decades (centuries?) of dubious pills and potions for weight loss, we may have actually found a silver bullet for weight loss.

Okay, it’s more complicated than a simple cure-all, but medical research has shown promising results from the use of GLP-1 agonists for weight loss. And patients want in.

Over 40% of Americans have obesity, and apparently 1.7% of Americans were prescribed a semaglutide medication in 2023, up 40-fold over the past five years. Science even named the GLP-1 agonists as its 2023 Breakthrough of the Year.

Digital health startups Ro, Noom, and Everlywell began online weight management programs in 2023, including shipping GLP-1 drugs direct to patient’s homes. Even legacy weight-loss brand Weight Watchers launched WeightWatchers® GLP-1 Programme, after its CEO apologized for past mistakes.

But the rise on GLP-1 meds was not all rosy. Many users faced unpleasant side effects… and the surge in popularity led to drug shortages impacting those with diabetes.

5. Healthcare providers warmed up to Artificial intelligence (AI) tools

In January, ChatGPT made headlines when it was announced it performed at or near the passing threshold of 60% accuracy on the United States Medical Licensing Exam (USMLE). By March, it was up to 85% accuracy.

In another study out in April, a panel of licensed healthcare professionals compared physician responses to health questions on Reddit to ChatGPT replies. The panel preferred ChatGPT’s responses 79% of the time and rated ChatGPT’s responses as higher quality and more empathetic.

While some providers are skeptical (threatened?) by AI, an AMA survey published in November found that two-thirds of providers say there is an advantage to using AI in medicine, with the most popular use cases being documentation of billing codes, medical charts, or visit notes and automation of insurance pre-authorization. They survey also found that over 1 in 5 providers use ChatGPT in their professional life and a third use it in their personal life.

6. In the first full year since the Supreme Court overturned the constitutional right to abortion, more Americans lost safe abortion access (but it did not, in fact, decrease abortions)

On June 24, 2022, the Supreme Court issued a ruling in Dobbs v. Jackson Women’s Health Organization that overturned the constitutional right to abortion. Prior to Dobbs, the federal standard was that abortions were permitted up to fetal viability. That federal standard was eliminated, and states were allowed to set their own policies regarding the legality of abortions.

As of mid-December 2023, seven states were restricting abortion at gestational limits that also would have been unconstitutional under Roe. Three of those states (South Carolina, North Carolina and Nebraska) introduced new gestational bans in 2023.

But we know that abortion bans don’t stop abortions, they only stop safe, medically-advised abortions. Or, they mean more medical tourism as women seek their human right to healthcare. In Florida, for instance, the number of abortions increased by 15% for the January to June 2023 period compared with a similar time frame in 2020. Increased travel from out-of-state individuals accounted for 65% of the overall increase.

7. Investor appetite in digital health cooled

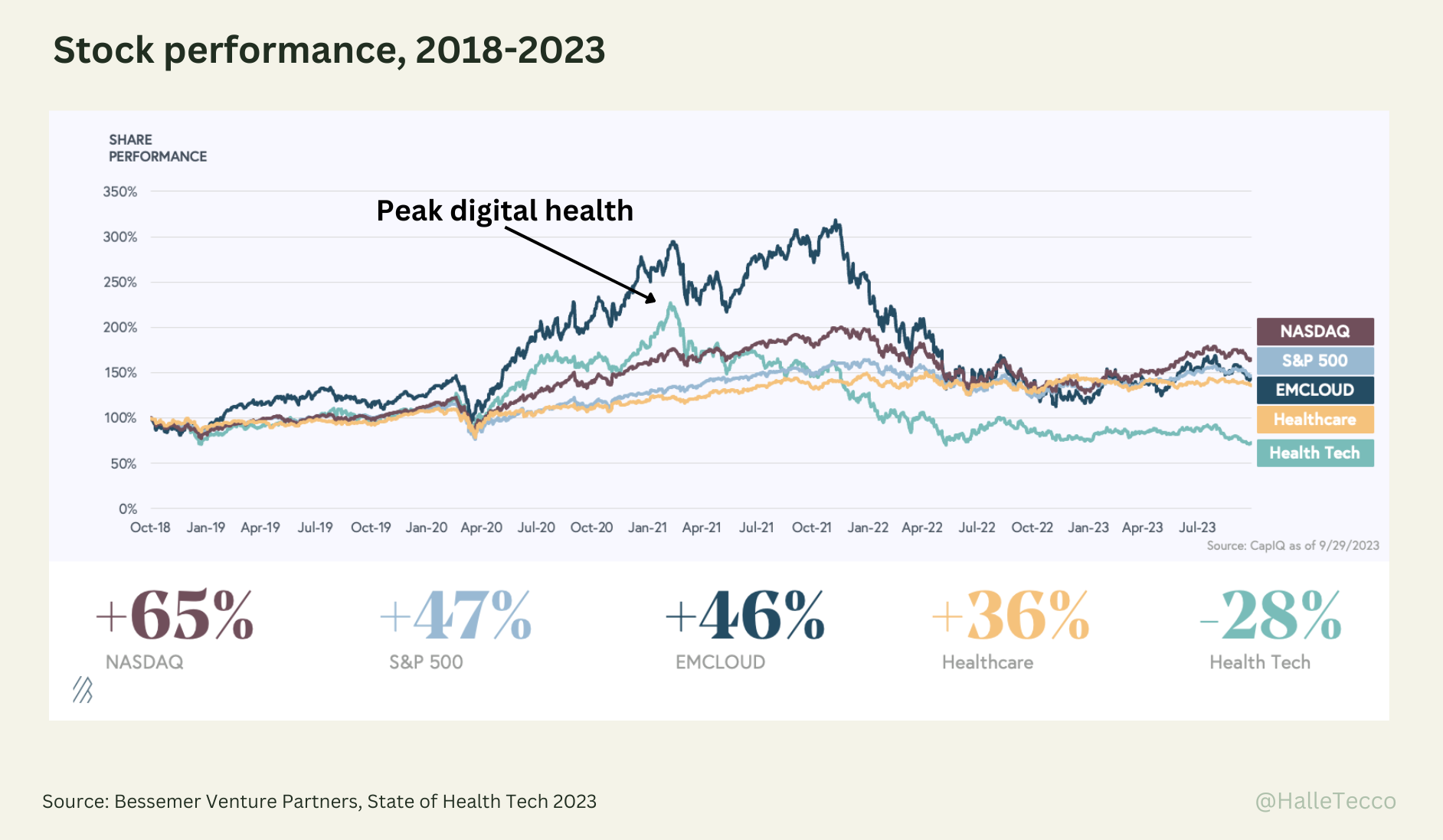

After hitting record highs in 2021 fueled by the COVID-19 pandemic and a shift to virtual care, things started to cool off in 2022 and worsened in 2023 for both VC and public market funding.

Publicly traded digital health companies saw an average share price decline of 28% since 2018, while other indices and legacy healthcare companies enjoyed growth in share price over the same period.

Zero digital health companies went public in 2023, meanwhile five de-listed (NextGen Healthcare, Babylon, Nant Health, Smile Direct Club, and Tabula Rasa HealthCare).